THE MORTGAGE GUARANTEE

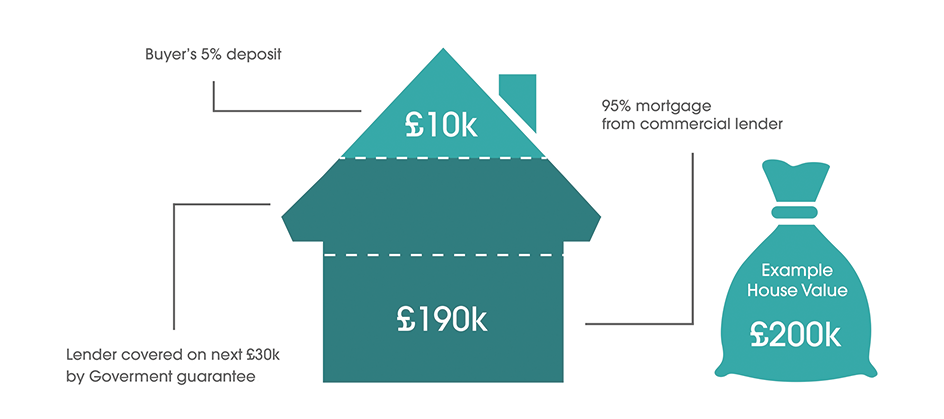

The second part of the Government's Help to Buy scheme, the Mortgage Guarantee, is completely different from the Equity Loan. It aims to encourage mortgage lenders to offer more mortgages to people with smaller deposits by making it less risky for them to do so. This part of the scheme does not involve any activeparticipation on the part of the borrower, who should simply benefit from access to a larger number of mortgage deals.

BACKGROUND

In the past there were hundreds of mortgages available at 90% to even 100% 'loan-to-value' (LTV), so if you had a 10%, 5% or even no deposit, there was plenty of choice available. To protect themselves against the risk of borrowers with these smaller deposits 'defaulting' (not making their mortgage payments), lenders traditionally took out insurance called Mortgage Indemnity Cover.

However, in the years lending up to the credit crunch. with most lenders offering higher LTV mortgages, such deals had increasingly become the norm and were considered a reasonable risk for lenders and somortgage indemnity had started to be phased out of the market.

WHY IS THE INDEMNITY IMPORTANT?

Mortgage indemnity could make a big difference if it allows borrowers access to more deals with smaller deposits. In recent years, while a handful of lenders have continued to offer mortgages above 80% LTV. and even up to 90% LTV, because such loans are deemed more risky by underwriters, these higher LTV mortgages have been charged at higher interest rates than home loans under 75% LTV.

The Government has now proposed that it plays the role of the insurer and, as of 1st January 2014, is providing indemnity to lenders offering higher LTV loans, promising to compensate them for part of their losses if mortgage borrowers fail to make their mortgage repayments. This may allow lenders to offer higher rate LTV deals at lower mortgage rates. Note that the indemnity only compensates the mortgage lender if you default on your loan, and offers no help to the borrower .

If you default on your mortgage you still owe the full outstanding balance.

A typical interest rate charged on a 95% mortgage is around 5.25% while the typical interest rate charged on a 75% mortgage is around 2.6%".

BORROWER CRITERIA

•You must be looking to buy your ONLY home, in which you will live.

• Help to Buy is NOT available for buy-to-let investment or the purchase of second homes

•You can be a first time buyer or moving home

•You can have any level of earnings (not restricted to £60.000 per household, as with the previous New Buy Scheme) however, your financial situation will be

assessed to ensure that you are not simply choosing to put down a smaller deposit and/or take out a smaller mortgage than you could otherwise afford on your own

•For the Equity Loan, you must be purchasing a newly-built property on a participating development

•You must have a deposit of at least 5% of the property's value

•You must be able to afford the mortgage.

For Help to Buy Mortgages in

Tel. 03303 500471

Tel. 03303 500471